India is gradually becoming a country with budding investors. With companies like Zomato, Swiggy, etc. issuing IPOs, many have taken towards instruments of the share markets to either plan their retirement of making money out of money. Those days of keeping money in bank accounts are long past. However, with risks associated with intra-day trading and equities, the middle-class man is eager to explore opportunities where returns are steady and the risk is minimal. Hence, here is a list of the top 10 mutual funds to invest in 2022.

• Axis Bluechip Fund

• Mirae Asset Large Cap Fund

• Parag Parikh Long Term Equity Fund

• UTI Flexi Cap Fund

• Axis Midcap Fund

• Kotak Emerging Equity Fund

• Axis Small Cap Fund

• SBI Small Cap Fund

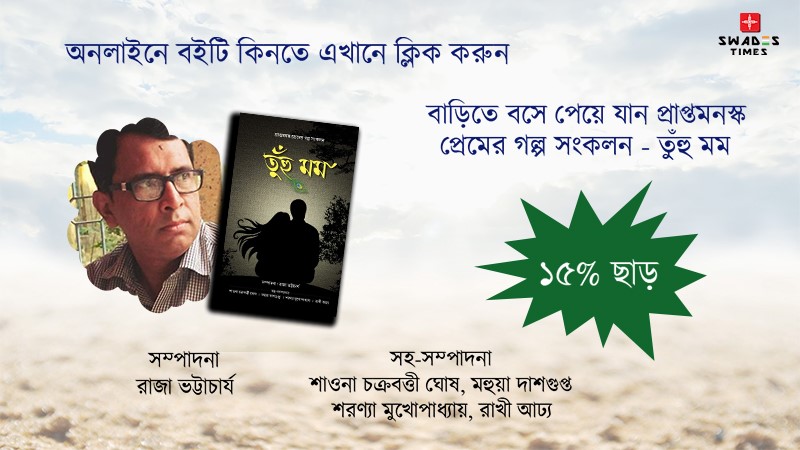

ADVERTISEMENT

• SBI Equity Hybrid Fund

• Mirae Asset Hybrid Equity Fund

However, certain things have to be kept in mind before investing in these schemes. First, learn about each area and if it fits your financial goals and risk tolerance.

For newbies to equity mutual funds, aggressive hybrid schemes (also known as balanced schemes or equity-oriented hybrid schemes) are excellent. These schemes invest in a combination of stock (65-80%) and debt (20-35). Because of the hybrid portfolio, they are thought to be less volatile than pure stock schemes. For highly cautious equities investors wanting to build long-term wealth with little volatility, aggressive hybrid schemes are the perfect investment vehicle.

Even when investing in equities, some equity investors want to play it safe. Large cap schemes are designed for people like this. These schemes invest in the top 100 equities and are considered to be less risky than other pure equity mutual fund schemes. They are also less volatile than mid-cap and small-cap funds. In short, if you want moderate returns with reasonable stability, you should invest in large cap schemes.

A regular equity investor (with a moderate risk tolerance) wishing to invest in the stock market should go no farther than flexi cap mutual funds (or diversified equity schemes). Based on the fund manager's assessment, these plans invest across market capitalisations and industries.

What about ambitious investors who want to increase their profits by taking on more risk?

They can, however, invest in mid-cap and small-cap schemes. Mid cap funds mostly invest in medium-sized firms, whilst small cap funds invest in smaller companies based on market capitalisation. These schemes can be volatile but they also have the potential to provide higher long-term returns. If you have a lengthy investing horizon and a tolerance for higher risk, you can invest in these mutual fund categories.

Finally, any search that begins with the term "best" is unlikely to provide you with the finest option. You should always select a plan that corresponds to your investing purpose, time horizon, and risk profile.

0 comments